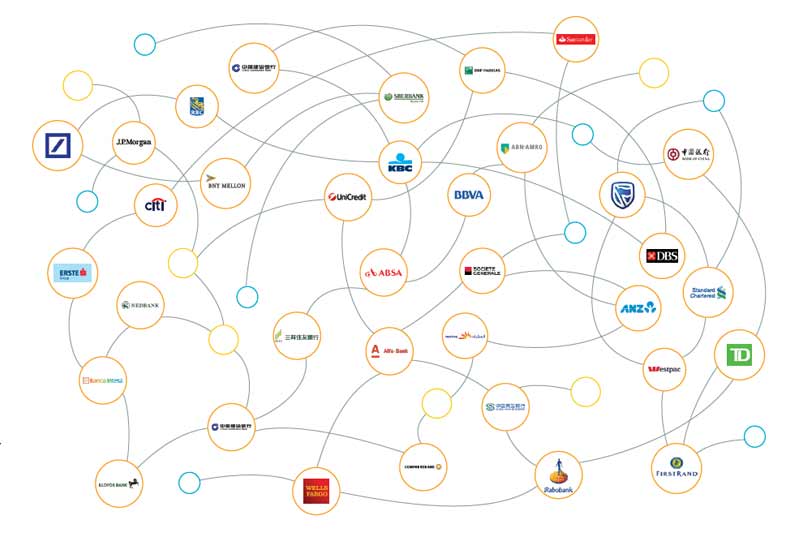

Thirty-three leading global transaction banks are involved in the PoC development and testing.

SWIFT ( Society for Worldwide Interbank Financial Telecommunication) has published an interim report on a proof of concept (PoC) for real-time Nostro reconciliation using a SWIFT-developed distributed ledger technology (DLT) sandbox with 33 global transaction banks, as part of its SWIFT gpi service. SWIFT gpi (global payments innovation) is a new standard for cross-border payments, available since January 2017, that combines real-time payments tracking with the certainty of same-day settlement. Since it became available in January 2017, over 110 global transaction banks have come onboard.

SWIFT’s DLT POC started in April 2017. The PoC is testing whether DLT can help banks reconcile Nostro accounts more efficiently and in real-time, while lowering costs and operational risk. The report provides an overview of the PoC to date, including technical objectives, early findings on the potential business benefits, as well as key challenges that still need to be addressed to achieve industry-wide adoption.