An increasing number of non-bank lenders are looking to initial coin offerings (ICOs) as a source of funds for trade finance lending.

ICOs – also referred to as token sales – are unregulated means of crowdfunding, using cryptocurrency. In theory, through an ICO, you can raise money from anybody, anywhere in the world.

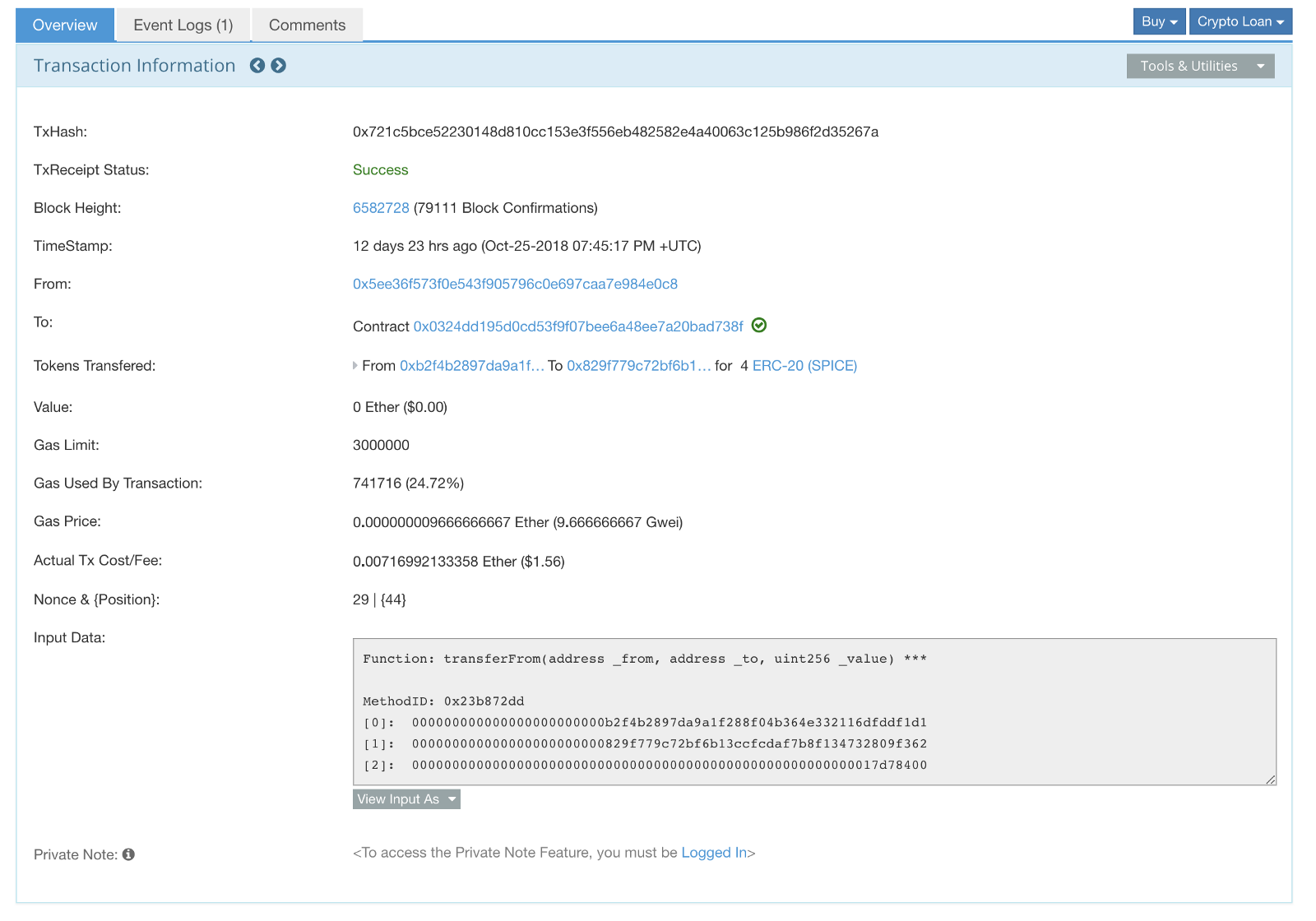

This is done by issuing digital tokens, which in turn gives investors a stake of the company. Early backers are usually motivated by a prospective return on their investment, as a startup’s success would often translate into a higher token value.

For trade finance lenders, it offers access to an unorthodox – and, theoretically, unlimited – pool of investors in a market that is booming. In July, a report by research firm Autonomous found that startups had raised in total a record US$1.27bn in the first half of 2017 through ICOs, while the top four ICOs of the year, according to research firm Smith and Crown, have to date raised US$660mn between them.

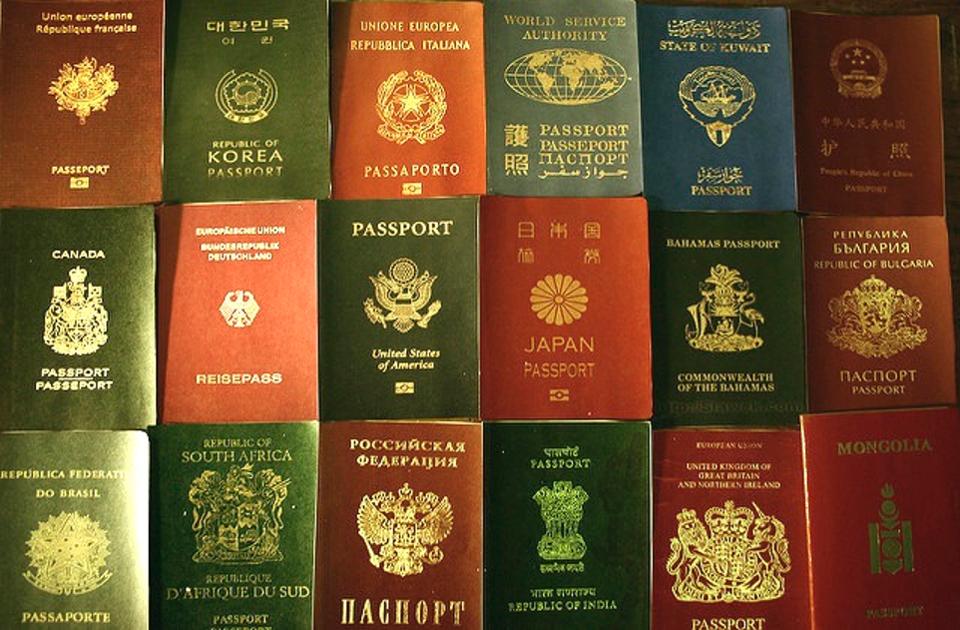

However, the market has come under intense scrutiny in recent weeks. Unlike mainstream fundraising activity, ICOs are unregulated. The anonymity of the market and the connections with the dark web have led to fears over money laundering and links to other sinister activity.

In September, China banned ICOs outright, saying they left investors unprotected and dismissing the entire practice as “illegal fundraising”.

The Hong Kong Monetary Authority (HKMA) chief executive Norman Chan followed this up by claiming that “bitcoin or other digital currencies do not require holders to trade under their real name, which allows them to be used for money laundering activities”. Similar warnings have come from the Monetary Authority of Singapore and the Securities and Exchange Commission in the US.

But while companies in the space say they have heeded the warnings of regulators, it seems not to have dampened enthusiasm for a fundraising model which, if used and managed correctly, can be much quicker and more efficient than traditional channels.

Source/More: ICOs: the next goldmine for trade finance lenders? | Global Trade Review (GTR)