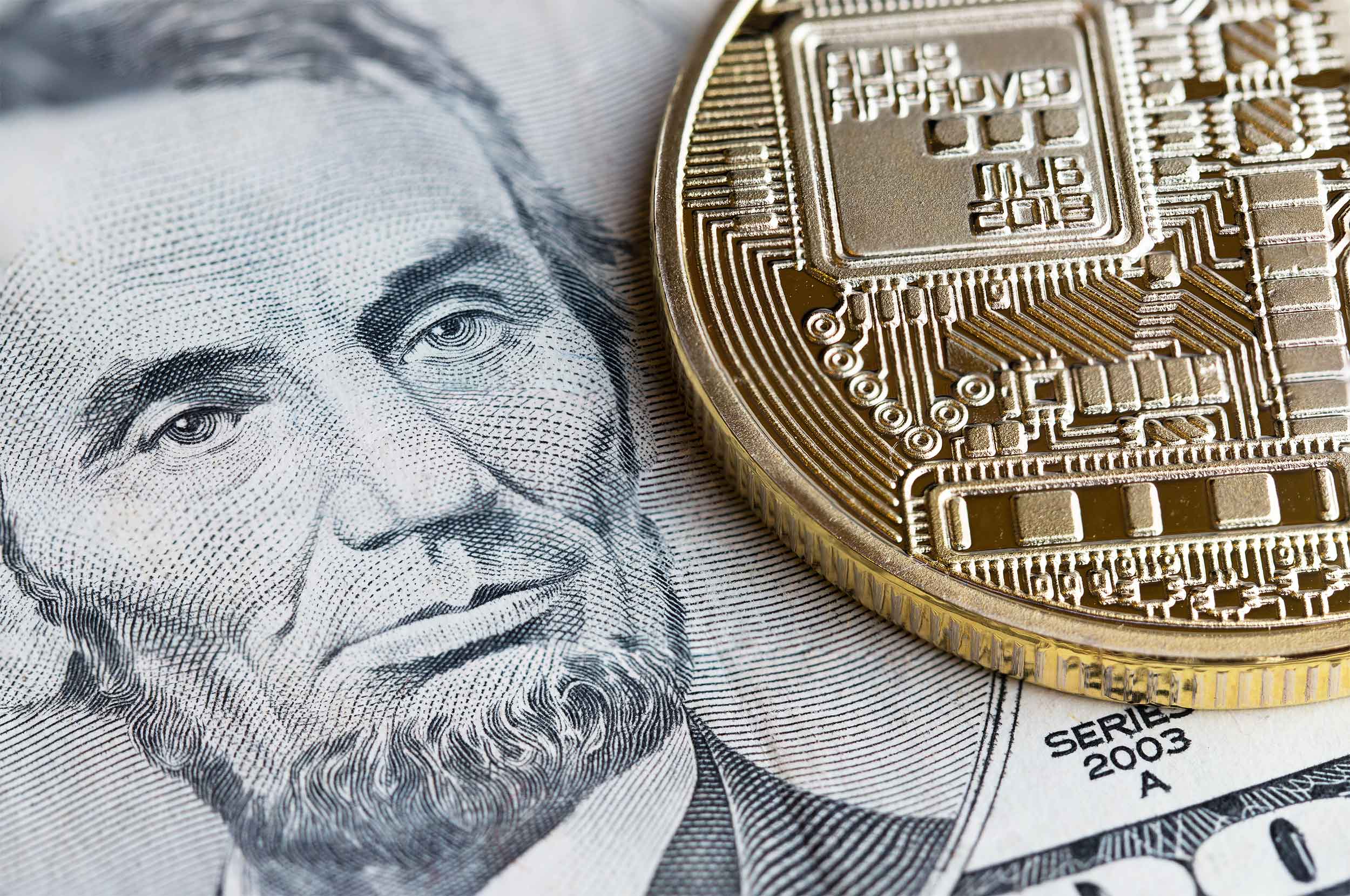

The Commodity Futures Trading Commission will let investors trade Bitcoin-related financial contracts.

Bitcoin has taken another step toward the financial mainstream, after a US regulator said it would let two traditional exchanges begin trading in Bitcoin-related financial contracts.

CME Group and CBOE Global Markets exchanges will offer investors Bitcoin futures from later this month.

The move sent the crypto-currency’s price up, continuing its volatile week.

Bitcoin hit a record above $11,400 on Wednesday, but then lost 20% of its value in the following 24 hours.

The announcement from the Commodity Futures Trading Commission (CFTC) that it will allow the futures to be traded was seen as a watershed moment for the currency.

It means that investors will be able to buy and sell “future” contracts in Bitcoins – an agreement to buy the crypto-currency, for example, in three months time at a certain price.

CME Group said trading would be available on its CME Globex electronic trading platform from 18 December.

To guard against volatility, CME and CBOE will put in place stricter than usual risk-management safeguards.

Source/More: US regulator approves Bitcoin trading – BBC News