When bitcoin skyrocketed in 2017, the electricity demand associated with it climbed to about 20.5 terawatt-hours a year

New York: There’s a growing debate over how much power will be sucked up by the world’s growing ranks of cryptocurrency miners.

Last week, Morgan Stanley analysts said miners of bitcoin could use as much as 140 terawatt-hours of electricity in 2018. That’s nearly 1% of global demand and enough to seize the limelight from electric cars as the explosive new source of power consumption.

On Tuesday, Credit Suisse Group dumped cold water on the notion that bitcoin would create “uncontrolled growth” in power demand. The bank’s analysts recalled overly bullish predictions about demand from marijuana growers and data centre operators who later found ways to curb their electricity use. Credit Suisse predicted a similar buzzkill for cryptocurrencies.

“This is a far cry from the power and environmental Armageddon that some have feared,” the analysts, led by Michael Weinstein, wrote in the report.

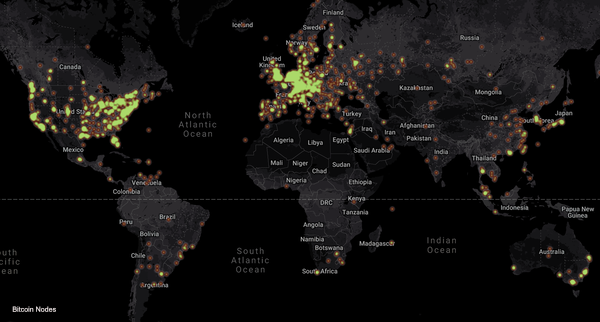

The debate underscores how difficult it’s been to project demand from a cryptocurrency craze that already has utilities and renewable energy developers worldwide marketing their supplies to the sector. When bitcoin skyrocketed in 2017, the electricity demand associated with it climbed to about 20.5 terawatt-hours a year, according to a report by Bloomberg New Energy Finance. Miners earn bitcoin-denominated rewards for performing complex, energy-intensive calculations needed to confirm transactions in the cryptocurrency.

Source/More: Bitcoin may be the new Marijuana when it comes to power demand – Livemint