Jon Matonis thinks equity and bond markets are the real bubbles, inflated by cheap central-bank money.

LONDON — A senior bitcoin advocate has dismissed fears that the market is in a bubble, saying instead that bond and stock markets around the world are being artificially inflated by central banks.

Bitcoin surged to over $20,000 a coin in the final months of 2017 but has since collapsed to about $7,000, leading skeptics to argue that that cryptocurrency was in a bubble that is now bursting.

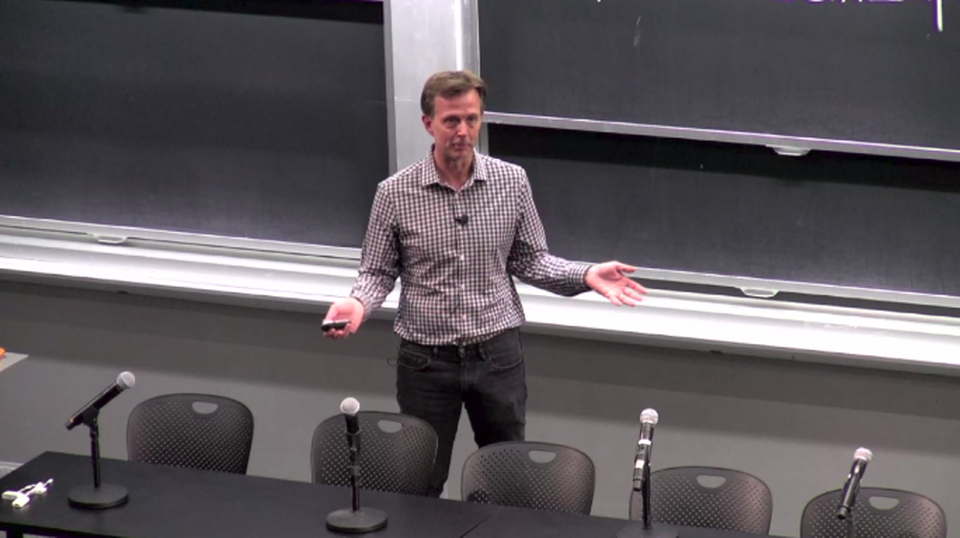

Jon Matonis, who helped found the Bitcoin Foundation in 2012, told Business Insider: “To the people who say bitcoin’s a bubble, I would say bitcoin is the pin that’s going to pop the bubble. The bubble is the insane bond markets and the fake equity markets that are propped up by the central banks. Those are the bubbles.”

Matonis, who spoke with Business Insider at the Innovate Finance conference in London earlier this month, believes we are entering a “post-legal-tender age,” which he says “isn’t driven by central banks.” Decentralized cryptocurrencies like bitcoin will power this shift, he said.

“Hard-coded into the original block zero, genesis block, of bitcoin was a headline from The Times of London saying, ‘Chancellor on the brink of second bailout for banks,'” Matonis said. “All they’re doing is papering over the bulls— infrastructure. That headline epitomizes what bitcoin is about — that’s why it was hard-coded in there.”

Matonis was a currency trader for the Japanese bank Sumitomo and for Visa before he helped set up the Bitcoin Foundation in 2012. The nonprofit was created to help compensate the core developers of the bitcoin protocol. Matonis sat on the foundation’s board from 2012 to 2014 and remains an executive director.

Source/More: Bitcoin Foundation’s Jon Matonis on bubble fears and crypto volatility – Business Insider