While cryptocurrency exchanges are mostly a legitimate business, the model of ‘crypto brokers’ is questionable

With the advent of the cryptocurrency industry, one of the first components that were required for the adoption of cryptos to spread was the existence of exchanges. The emerging trend of so-called “cryptocurrency brokers” however, appears to be attracting unwanted attention from multiple financial regulators worldwide.

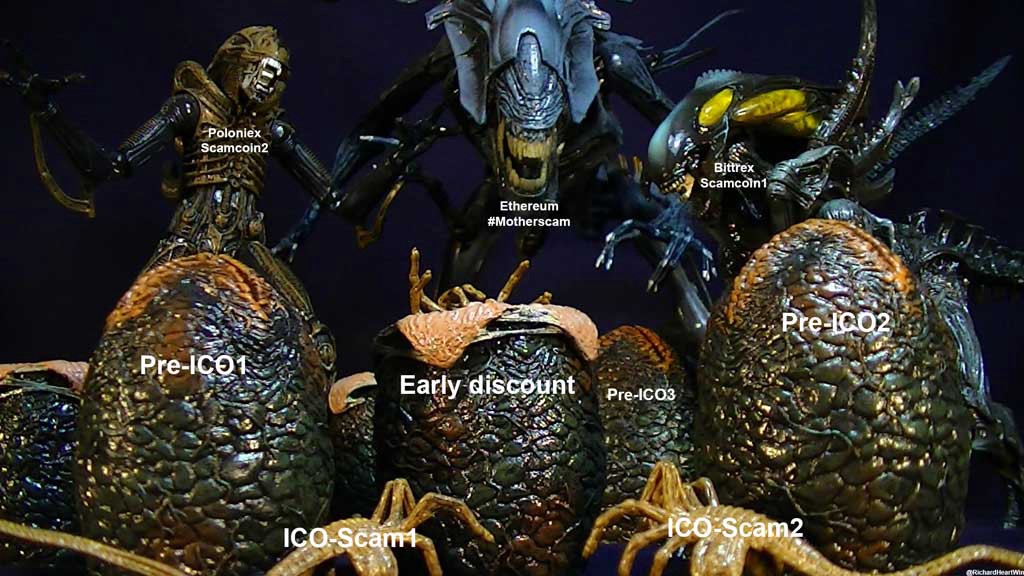

Just as binary options were partly responsible for the massive crackdown on forex and CFDs brokers, now crypto brokers that claim to be resellers of cryptos are in a way acting against the interest of legitimate exchanges.

Such brokers are not regulated anywhere and are not offering CFDs on crypto. Instead, they claim to be buying cryptocurrencies on exchanges and hold that for clients. Except there is no way to verify whether they actually do it, as the deposits of their clients are quickly eaten away by the extreme overnight interest rates they charge to hold a position.

The end result is that the providers either end up with the client’s crypto which is unaffected by any interest rates, or they never buy the crypto in the first place.

Source/More: ‘Crypto Broker’ Business Model Raises Suspicions from Authorities Worldwide | Finance Magnates