Richard Turnill, BlackRock’s chief investment strategist, explains why he is bullish on stocks, confident in the Fed, and not worried about a recession.

- We sat down with Richard Turnill, global chief investment strategist for BlackRock, the world’s largest money manager.

- He’s bullish on stock markets around the world.

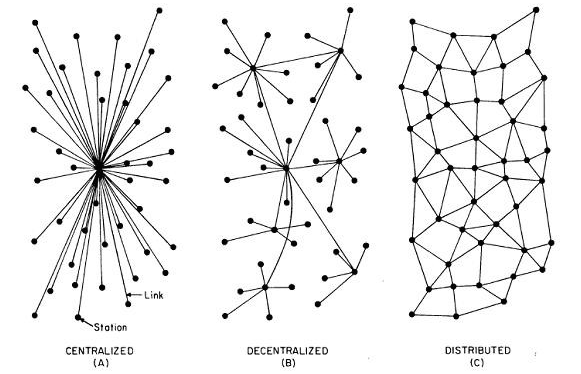

- While BlackRock is exploring blockchain technology, Turnill says there’s no way to assess a fair price for bitcoin, and doesn’t own any.

Richard Turnill is the chief investment strategist at BlackRock, the world’s largest money manager with $5.98 trillion under management.

In an interview with Business Insider’s Sara Silverstein, Turnill spoke candidly about market valuations and why he’s still bullish on stocks today, despite fears that equities may have reached a peak.

He says that, despite record-low volatility and a longer streak of economic growth than has been seen in recent history, there’s still room left to profit from the current business cycle, which isn’t close to a downturn just yet.

Here’s the interview transcript, which has been lightly edited for length and clarity.

Sara Silverstein: After looking over a bunch of your research notes, you seem to be bullish on almost everything.

Richard Turnill: We’re certainly bullish on stocks, on risk assets right now.

Silverstein: To jump right in there, how do you feel about valuations? We’ve been talking a lot about valuations seeming really high for equities.

Turnill: The market’s gone up a long way, and that’s making people nervous. When people look at valuations, there are two concerns actually. When we look at most parts of the stock market today, we think they’re reasonable. Importantly, when you think about what’s the right value or fair value for the stock market, you have to think about what’s the economic environment and interest environment we’re in. Actually, in an environment of sustained economic growth and low interest rates, relatively high valuations can be supported for some time. We’re actually much less concerned about valuations than many others.

Although we would say that there are parts of the market which do look more highly valued. The US market looks more expensive than many international markets, for example. So whilst we think the US market can do well, we see more upside in some of the international markets today.

Silverstein: Within the US market, are you seeing opportunities there as well?

Turnill: We absolutely see opportunities within the US market, and actually the economic environment in the US is very attractive. We see the Fed gradually raising interest rates going forward. That’s an environment which is very good news for technology stocks.

It’s also very good news for financial stocks, which do very well in an environment of gradually rising interest rates over time. We prefer those two sectors. It’s not so good for some sector such as consumer staples, some of the more defensive bond proxies, which I think are going to struggle to keep up in a rising interest rate environment.

Source/More: Richard Turnill, BlackRock chief investment strategist, interview – Business Insider